Discover How to Participate in Staking

Product Introduction

Staking is a digital asset yield product launched by the WEEX platform. By subscribing to Staking products, users can stake their idle digital assets and earn corresponding Staking rewards.

The product supports both Flexible Staking and Fixed-term Staking, meeting different user needs for liquidity and returns.

Flexible Options: Supports both flexible and fixed-term products. Flexible Staking allows redemption at any time, while fixed-term products offer higher potential returns.

Daily Interest Accrual: Rewards are calculated on a daily basis and automatically distributed, with no manual operation required.

Transparent Returns: The page displays the reference Annual Percentage Rate (APR), allowing users to clearly review reward rules before subscribing.

Easy Operation: Supports subscription directly from the Spot Account or Funding Account, enabling one-click participation.

Usage Instructions

1. How to Participate in Staking

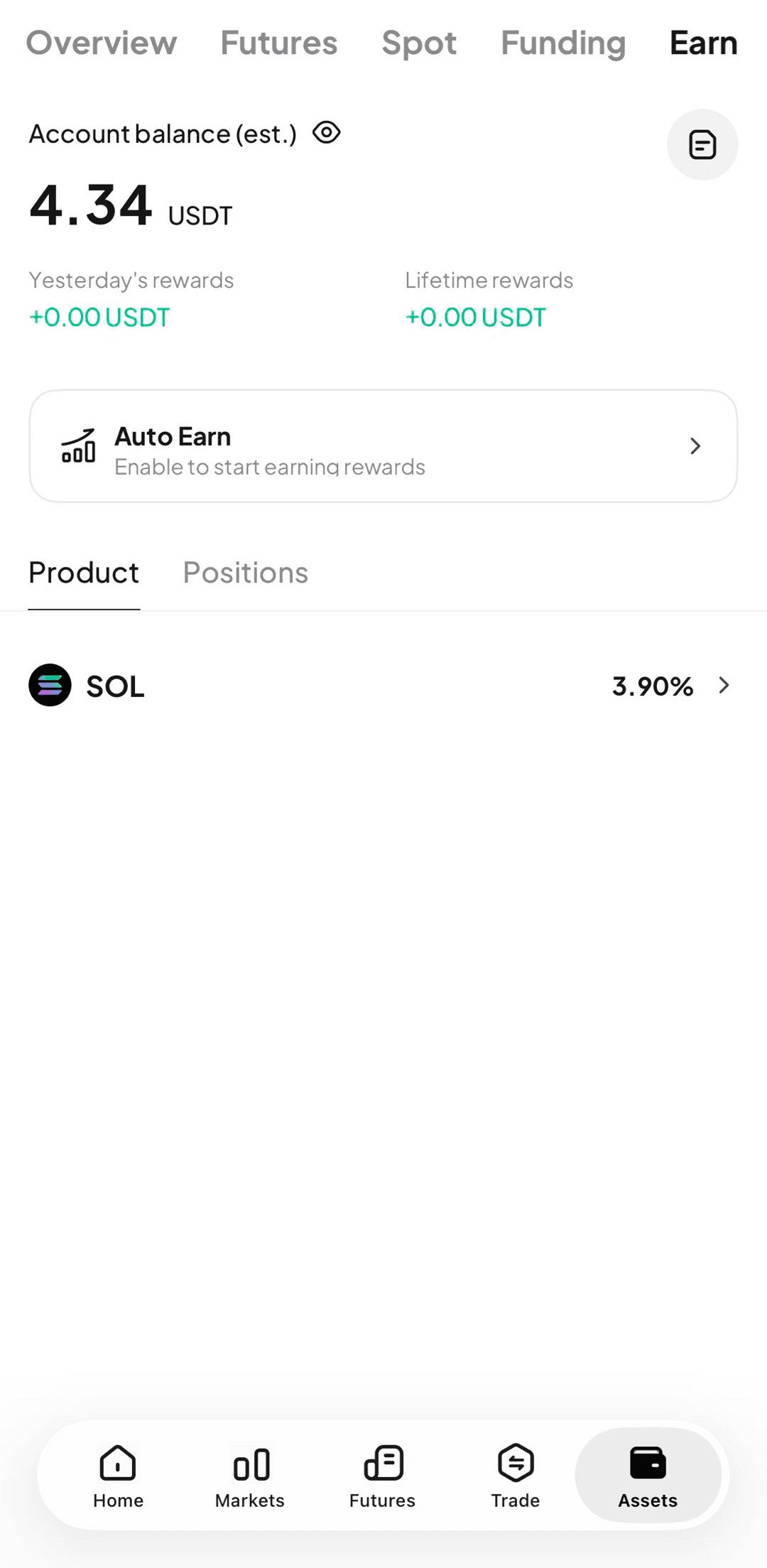

Step 1: Open the APP and navigate to the [Assets] page to view the Staking products.

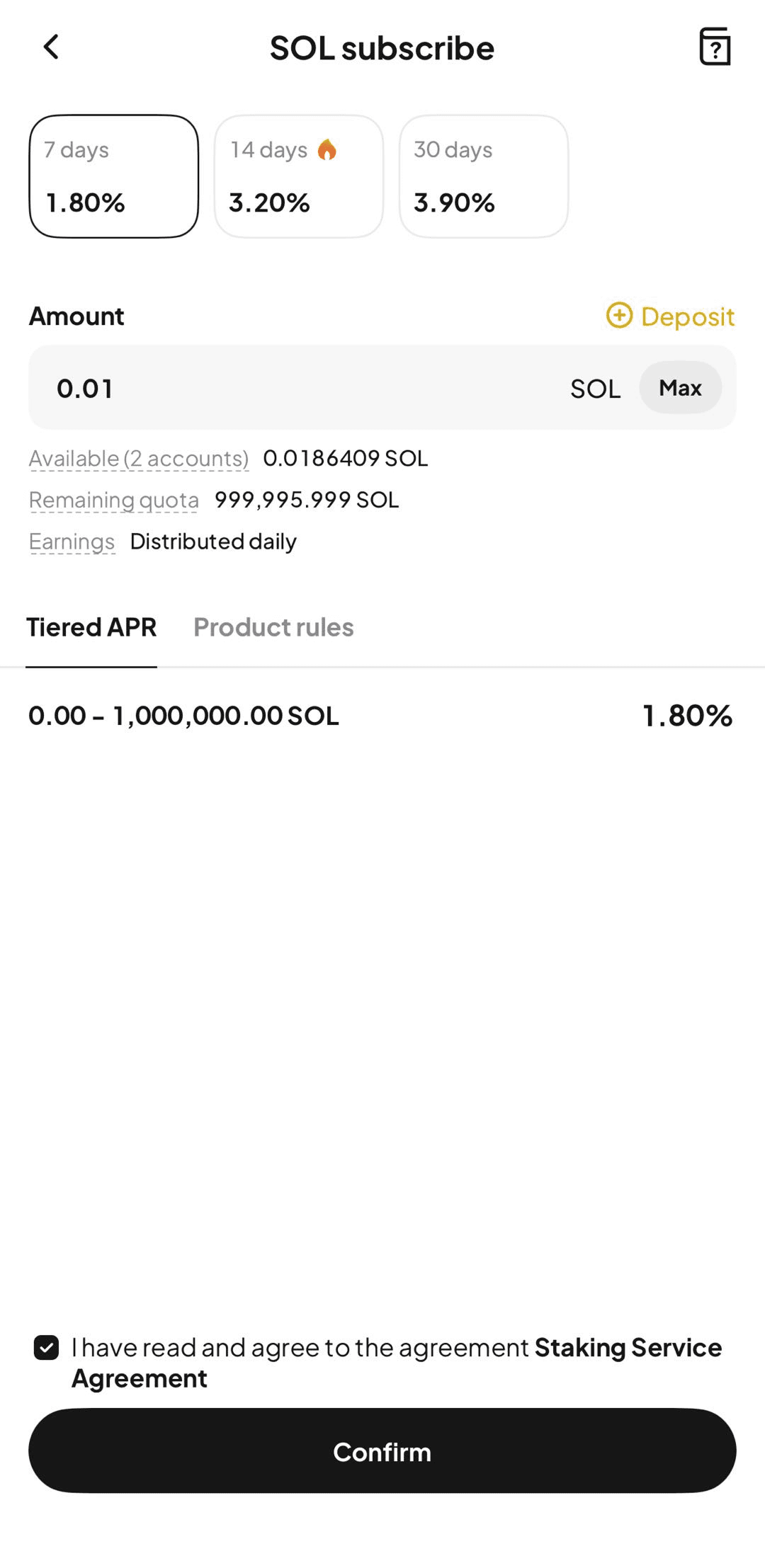

Step 2: From the Staking product list, select the desired cryptocurrency and product type (Flexible / Fixed-term).

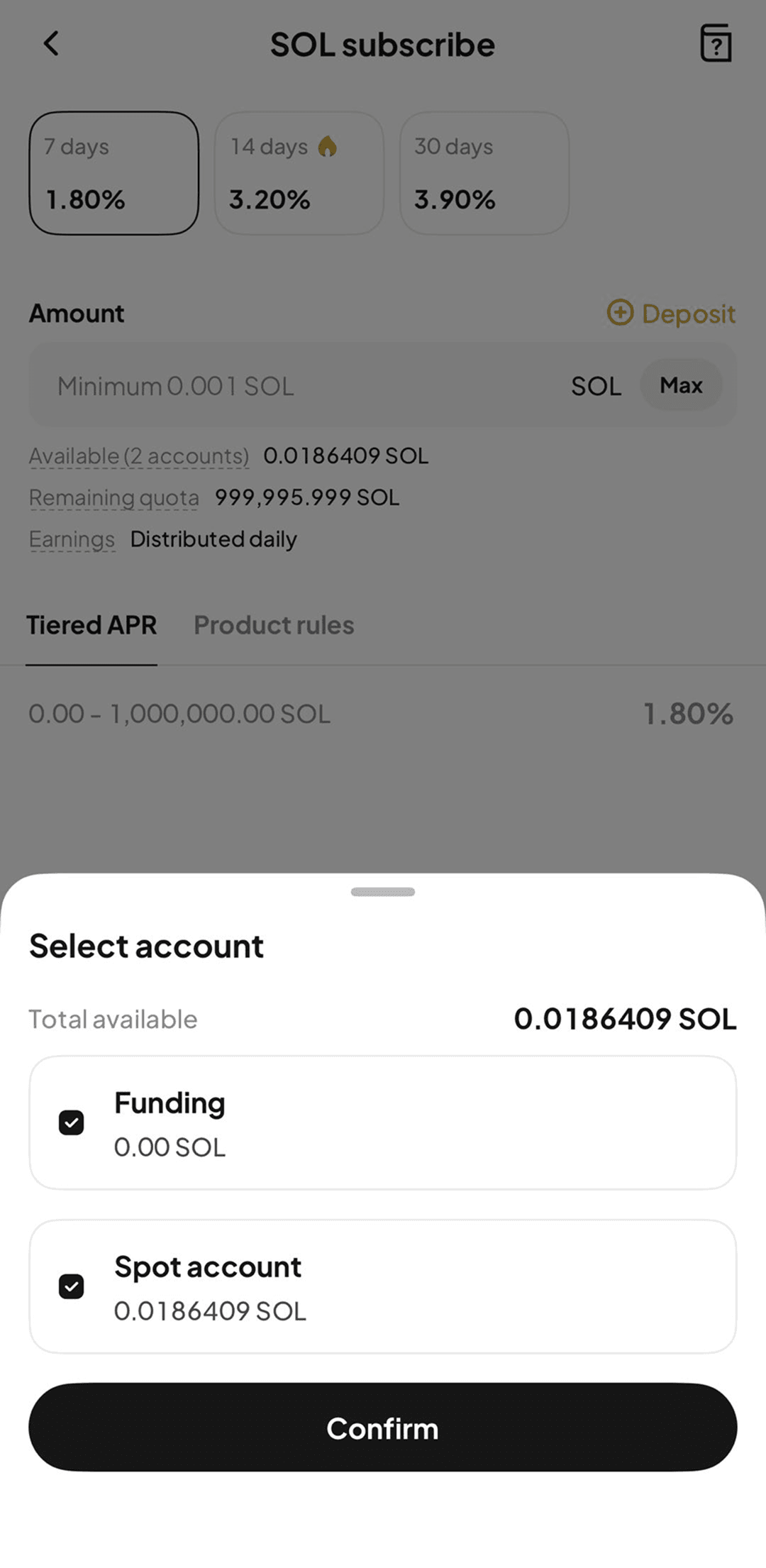

Step 3: Enter the subscription page, input the subscription amount, and select the asset source account (Spot Account / Funding Account).

Step 4: Read and check the Staking Service Agreement, then tap [Confirm] to complete the subscription.

After successful subscription, interest will start accruing automatically. Users can view key information such as the next reward distribution time, interest accrual cycle, and product end date (for fixed-term products) on the product details page, ensuring clear visibility of reward distribution and product progress.

2. Interest Accrual Rules

Flexible Staking:

1.Interest starts accruing immediately after successful subscription

2.Rewards are calculated daily

3.Rewards are automatically distributed to the Funding Account

4.Redemption is available at any time. Rewards are calculated based on complete natural days of holding; any holding period shorter than one full interest day will not be counted toward rewards.

Fixed-term Staking:

1.Interest starts accruing after successful subscription

2.Interest accrues daily during the lock-up period

3.Rewards are accumulated daily and distributed uniformly to the Funding Account

4.Early redemption is supported; however, all accrued rewards (including distributed rewards) will be deducted upon early redemption.

3. Reward Display and Viewing Methods

1.The APR displayed on the page is a reference maximum annualized rate. Actual rewards are subject to system settlement.

2.Accrued rewards and holding details can be viewed under the corresponding asset on the [Assets] page, for example: SOL: 0.01688297

4. Subscription and Redemption Rules

1.Subscription Asset Source: Supports subscription using assets from the Funding Account or Funding Account + Spot Account.

2.Redemption Rules:

Flexible Products: Redemption is supported at any time.

- Fixed-term Products: Early redemption is supported. Upon early redemption, all rewards generated by the product (including distributed and undistributed rewards) will be deducted, and the remaining principal will be returned to the original account.

Important Notes

- Staking products are digital asset financial services. Returns do not guarantee principal protection. Users should participate based on their own risk tolerance.

- The displayed expected APR may be dynamically adjusted based on market and on-chain conditions. Please refer to the real-time page display for the latest information.

- Fixed-term Staking involves liquidity restrictions during the lock-up period. Please ensure you can bear the lock-up risk before subscribing.

- Minimum subscription amounts and reward rules may vary by cryptocurrency and product. Please refer to the specific product page for details.

- eature entry points, page layouts, and product rules may vary depending on the APP version. Please refer to the real-time display within the APP.

Staking Product FAQ

1. What is Staking?

Staking refers to a method where users stake their digital assets to earn corresponding Staking rewards. The platform offers both flexible and fixed-term Staking products.

2. How are Staking rewards calculated and viewed?

Flexible Products: Interest is calculated daily, and rewards are automatically distributed to the Funding Account each day.

Fixed-term Products: Interest is calculated daily, rewards are accumulated on a daily basis, and automatically distributed to the Funding Account. Accumulated rewards and holding details can be viewed on the [Assets] page.

3. Which accounts can be used to subscribe to Staking products?

Users can subscribe using assets from the Funding Account or Funding Account + Spot Account.

4. Can I redeem it at any time?

Flexible Staking: Redemption is available at any time, with rewards settled based on actual holding days.

Fixed-term Staking: Early redemption is supported, but all accrued rewards will be deducted.

5. Are there risks associated with Staking products?

Staking is an on-chain financial product and involves market volatility and liquidity risks. All returns do not guarantee principal protection. Users should choose products prudently based on their risk preferences.

You may also like

U.S. Oil (USOR) Price Prediction 2026–2030

Key Takeaways U.S. Oil (USOR) is a speculative Solana-based crypto project that aims to index the United States…

USOR Surges on Meme Narrative Despite No Real-World Asset Backing

Key Takeaways: USOR, a Solana-based token, has seen a notable surge driven by speculative narratives rather than verifiable…

How to Buy U.S. Oil Reserve (USOR) Cryptocurrency

Key Takeaways U.S. Oil Reserve (USOR) is a Solana-based token primarily traded on decentralized exchanges (DEXs). Claims have…

USOR vs Oil ETFs: Understanding Why the ‘Oil Reserve’ Token Doesn’t Track Crude Prices

Key Takeaways The U.S. Oil Reserve (USOR) token has become noteworthy for its claims, yet it does not…

Trend Research Reduces Ether Holdings After Major Market Turbulence

Key Takeaways: Trend Research has significantly cut down its Ether holdings, moving over 404,000 ETH to exchanges recently.…

Investors Channel $258M into Crypto Startups Despite $2 Trillion Market Sell-Off

Key Takeaways: Investors pumped approximately $258 million into crypto startups in early February, highlighting continued support for blockchain-related…

NBA Star Giannis Antetokounmpo Becomes Shareholder in Prediction Market Kalshi

Key Takeaways: Giannis Antetokounmpo, the NBA’s two-time MVP, invests in the prediction market platform Kalshi as a shareholder.…

Arizona Home Invasion Targets $66 Million in Cryptocurrency: Two Teens Charged

Key Takeaways Two teenagers from California face serious felony charges for allegedly attempting to steal $66 million in…

El Salvador’s Bukele Approval Reaches Record 91.9% Despite Limited Bitcoin Use

Key Takeaways: El Salvador President Nayib Bukele enjoys a record high approval rating of 91.9% from his populace,…

Crypto Price Prediction for February 6: XRP, Dogecoin, and Shiba Inu’s Market Movements

Key Takeaways: The crypto market experienced a notable shift with Bitcoin’s significant surge, impacting altcoins like XRP, Dogecoin,…

China Restricts Unapproved Yuan-Pegged Stablecoins to Maintain Currency Stability

Key Takeaways: China’s central bank and seven government agencies have banned the issuance of yuan-pegged stablecoins abroad without…

Solana Price Prediction: $80 SOL Looks Scary – But Smart Money Just Signaled This Might Be the Bottom

Key Takeaways Despite Solana’s descent to $80, some traders find security as smart money enters the fray, suggesting…

XRP Price Prediction: Major Ledger Upgrade Quietly Activated – Why This Could Be the Most Bullish Signal Yet

Key Takeaways: The activation of the Permissioned Domains amendment on XRPL represents a significant development in XRP’s potential…

Dogecoin Price Prediction: Death Cross Confirmed as DOGE Falls Below $0.10 – Is DOGE Reaching Zero?

Key Takeaways The death cross event signals potential bearish trends for Dogecoin as its price dips under $0.10,…

Stablecoin Inflows Have Doubled to $98B Amid Selling Pressure

Key Takeaways Stablecoin inflows to crypto exchanges have surged to $98 billion, doubling previous levels amidst heightened market…

Coinbase UK Executive Declares Tokenised Collateral a Mainstream Financial Force

Key Takeaways Tokenised collateral is transitioning from its initial experimental stages into becoming core infrastructure within financial markets.…

Best Crypto to Buy Now February 6 – XRP, Solana, Bitcoin

Key Takeaways The cryptocurrency market witnesses volatility amid a technology-sector selloff, but opportunities still exist for keen investors.…

Why Is Crypto Down Today, February 6, 2026

Key Takeaways The global cryptocurrency market has seen an 8% decline in the last 24 hours, standing at…

U.S. Oil (USOR) Price Prediction 2026–2030

Key Takeaways U.S. Oil (USOR) is a speculative Solana-based crypto project that aims to index the United States…

USOR Surges on Meme Narrative Despite No Real-World Asset Backing

Key Takeaways: USOR, a Solana-based token, has seen a notable surge driven by speculative narratives rather than verifiable…

How to Buy U.S. Oil Reserve (USOR) Cryptocurrency

Key Takeaways U.S. Oil Reserve (USOR) is a Solana-based token primarily traded on decentralized exchanges (DEXs). Claims have…

USOR vs Oil ETFs: Understanding Why the ‘Oil Reserve’ Token Doesn’t Track Crude Prices

Key Takeaways The U.S. Oil Reserve (USOR) token has become noteworthy for its claims, yet it does not…

Trend Research Reduces Ether Holdings After Major Market Turbulence

Key Takeaways: Trend Research has significantly cut down its Ether holdings, moving over 404,000 ETH to exchanges recently.…

Investors Channel $258M into Crypto Startups Despite $2 Trillion Market Sell-Off

Key Takeaways: Investors pumped approximately $258 million into crypto startups in early February, highlighting continued support for blockchain-related…

Earn

Earn