Chainalysis report: Stablecoins, TradFi and RWA are leading the next wave of Web3

Original title: Growth Opportunities: Stablecoins, TradFi Engagement, and Tokenization Lead Web3's Next Wave

Original source: Chainalysis

Original translation: 1912212.eth, Foresight News

The cryptocurrency industry has entered a new stage of maturity, driven by increasing adoption, continued innovation, and deeper integration with the traditional financial system around the world.

This year, BTC hit new all-time highs in March and December, reflecting huge demand. At the same time, DeFi's position in the global economy is constantly consolidating, and global capital inflows are also approaching new highs. In addition, traditional finance (TradFi) is revitalized, and funds are pouring into areas such as stablecoins and crypto exchange-traded products (ETP) markets, indicating that cryptocurrencies are quietly fulfilling their promise to reshape the global financial infrastructure.

This is not just another market cycle, but a critical moment for cryptocurrencies.

Atypical Bull Market

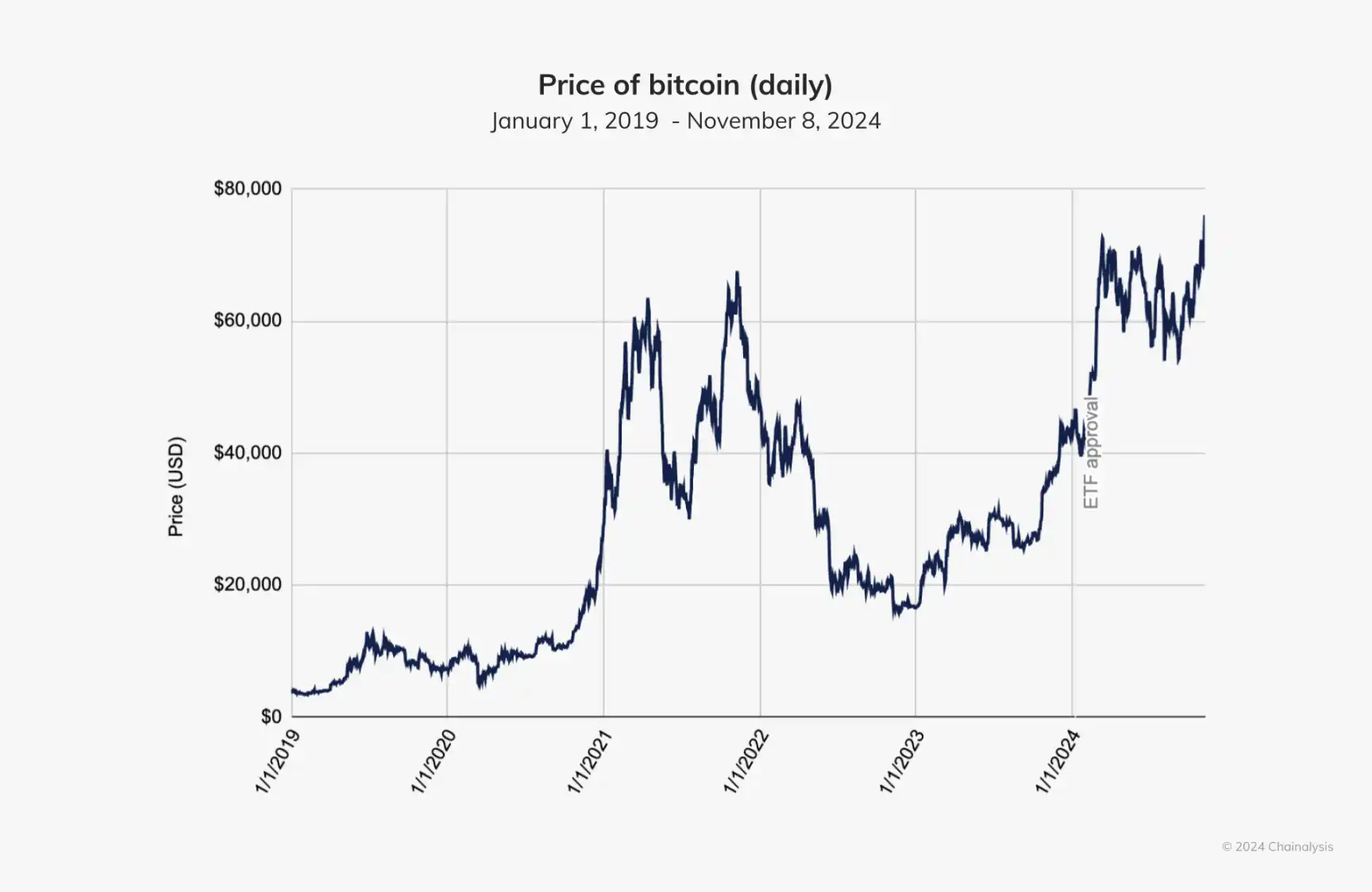

At the end of 2023, BTC began to rise, marking the beginning of a new round of rising market.

On March 5, 2024, BTC broke through its previous all-time high, rising to more than $73,000; in December of the same year, it broke through the $100,000 mark again.

In addition, the transfer activity of all digital assets has exceeded the historical highs of the end of 2020 and 2021, indicating that the activity of this round of market cycle is far more active than the previous bull market.

From late 2023 to early 2024, DeFi began to show signs of recovery, with activity levels reaching previous all-time highs, as shown below.

Current asset prices and DeFi activity are not the only indicators of market adaptability and resilience - global adoption of stablecoins, explosive interest in traditional finance (TradFi), and the rise of services for new use cases such as tokenization (described below) all indicate that cryptocurrencies are becoming more widely accepted and integrated into the global economy.

Global Utility Driving the Rise of Stablecoins

Stablecoins are typically pegged 1:1 to the U.S. dollar or other fiat currencies, combining the efficiency, security, and transparency of cryptocurrencies without the volatility risks common in other crypto markets.

While major cryptocurrencies such as BTC and ETH often dominate the headlines and offer returns that stablecoins cannot match, stablecoins have surpassed other types of cryptocurrencies in terms of adoption. In recent months, stablecoins have accounted for more than half of all on-chain transaction volume, reaching as much as 75%.

By making the stability of the U.S. dollar accessible to anyone in the world with an internet connection, stablecoins provide a critical solution for residents of countries facing currency volatility, both to protect savings and to facilitate commercial transactions.

The growing prominence of stablecoins in overall trading activity shows that this asset class has achieved a high level of utility among crypto users.

Bitcoin and Ethereum ETPs Mark a Historic Convergence of Cryptocurrency and Traditional Finance

Traditional finance (TradFi) validation of cryptocurrencies in 2024 reached a historic milestone, with the launch of spot Bitcoin exchange-traded products (ETPs) in the U.S. market further bolstering institutional investor interest. Exchange-traded funds (ETFs) – the most popular form of ETPs – have attracted significant interest from both retail and institutional investors.

With the launch of cryptocurrency ETFs, the entire market has experienced a rally based on this, as these funds offer regulated mainstream investment vehicles that can gain exposure to cryptocurrencies, which often attract investors who may be hesitant about the complexity and security issues of using traditional crypto trading platforms directly.

Daily trading volumes for Bitcoin ETFs have surged, approaching $10 billion in daily trading volume in March. Bitcoin ETF inflows have also surpassed those of the first net gold ETF launched in 2005 (adjusted for inflation), as shown in the chart below, making it the fastest growing ETF in history.

The price of Bitcoin began to rise rapidly following the news of the approval of the Bitcoin ETF on January 10, 2024, and trading began shortly thereafter.

By providing easier access to cryptocurrencies through traditional trading platforms, ETPs can unlock new sources of demand for the underlying asset, which appears to be one of the important factors driving the recent price increase of Bitcoin (BTC).

While it is difficult to pinpoint the exact impact of the launch of Bitcoin ETPs in the U.S., it is widely believed to have boosted market optimism and expanded institutional investor exposure to Bitcoin. The surge in demand reflects the unique appeal of ETPs among retail and institutional investors, offering a regulated and familiar way to gain exposure to Bitcoin without the complexity of managing private key wallets.

Tokenization: Real World Assets (RWAs) Are Growing

The excitement surrounding the mass tokenization of real world assets (RWAs) is quietly changing the asset management and investment landscape, with many traditional finance (TradFi) giants, such as Franklin Templeton, already taking a stake in this market. Goldman Sachs reportedly plans to launch a crypto trading platform focused on tokenization in the next 12 to 18 months.

RWAs refer to any asset with value — whether tangible or intangible — that derives its value from something other than a blockchain. Through tokenization, the rights to these assets, from real estate to art to intellectual property, are represented as tokens on the blockchain. This process not only simplifies the process of selling and trading these assets, but also increases their accessibility to a wider audience, creating a more efficient and liquid market. RWAs also promise to enhance transparency in the investment market, as all transactions are recorded on-chain.

Currently, most RWA projects focus on tokenizing relatively simple and stable financial instruments, such as U.S. Treasuries, and lending platforms such as Goldfinch and Ondo Finance, which rely on tokenized RWAs as their core, have captured the majority of the RWA market. According to data compiled by asset management company 21.co, the total market value of tokenized projects has exceeded $100 billion.

Although still in its early stages, the growing prominence of RWAs is a key step towards a future where most value transfers will take place on the blockchain, promoting a unified, open, and less frictional global market.

What the Cryptocurrency Industry Maturation Might Mean for Organizations

When we look at the progress of the crypto ecosystem, it is clear that we are experiencing a huge shift in perception and usage. While the cryptocurrency market may experience volatility and long bear cycles, one trend is consistent: wallets holding positive balances have grown linearly and continue to rise. Currently, over 400 million wallets hold cryptocurrency.

While one wallet does not mean only one user, as institutions and individuals can manage multiple wallets, the sheer volume of growth suggests that cryptocurrency adoption is steadily increasing.

As the influence of cryptocurrency continues to grow, it becomes even more important to measure success in this new paradigm. For organizations, adapting to the on-chain reality is more than just keeping up with technological advancements — it requires a complete reassessment of operating models to take advantage of the unique opportunities blockchain presents.

You may also like

February 9th Market Key Intelligence, How Much Did You Miss?

After being questioned by Vitalik, L2s are collectively saying goodbye to the "cheap" era

WEEX AI Trading Hackathon Paris Workshop Reveals: How Retail Crypto Traders Can Outperform Hedge Funds

Witness how WEEX's Paris AI Trading Hackathon revealed AI's edge over human traders. Explore key strategies, live competition results & how to build your own AI trading bot.

U.S. Oil (USOR) Price Prediction 2026–2030

Key Takeaways U.S. Oil (USOR) is a speculative Solana-based crypto project that aims to index the United States…

USOR Surges on Meme Narrative Despite No Real-World Asset Backing

Key Takeaways: USOR, a Solana-based token, has seen a notable surge driven by speculative narratives rather than verifiable…

How to Buy U.S. Oil Reserve (USOR) Cryptocurrency

Key Takeaways U.S. Oil Reserve (USOR) is a Solana-based token primarily traded on decentralized exchanges (DEXs). Claims have…

USOR vs Oil ETFs: Understanding Why the ‘Oil Reserve’ Token Doesn’t Track Crude Prices

Key Takeaways The U.S. Oil Reserve (USOR) token has become noteworthy for its claims, yet it does not…

Trend Research Reduces Ether Holdings After Major Market Turbulence

Key Takeaways: Trend Research has significantly cut down its Ether holdings, moving over 404,000 ETH to exchanges recently.…

Investors Channel $258M into Crypto Startups Despite $2 Trillion Market Sell-Off

Key Takeaways: Investors pumped approximately $258 million into crypto startups in early February, highlighting continued support for blockchain-related…

NBA Star Giannis Antetokounmpo Becomes Shareholder in Prediction Market Kalshi

Key Takeaways: Giannis Antetokounmpo, the NBA’s two-time MVP, invests in the prediction market platform Kalshi as a shareholder.…

Arizona Home Invasion Targets $66 Million in Cryptocurrency: Two Teens Charged

Key Takeaways Two teenagers from California face serious felony charges for allegedly attempting to steal $66 million in…

El Salvador’s Bukele Approval Reaches Record 91.9% Despite Limited Bitcoin Use

Key Takeaways: El Salvador President Nayib Bukele enjoys a record high approval rating of 91.9% from his populace,…

Crypto Price Prediction for February 6: XRP, Dogecoin, and Shiba Inu’s Market Movements

Key Takeaways: The crypto market experienced a notable shift with Bitcoin’s significant surge, impacting altcoins like XRP, Dogecoin,…

China Restricts Unapproved Yuan-Pegged Stablecoins to Maintain Currency Stability

Key Takeaways: China’s central bank and seven government agencies have banned the issuance of yuan-pegged stablecoins abroad without…

Solana Price Prediction: $80 SOL Looks Scary – But Smart Money Just Signaled This Might Be the Bottom

Key Takeaways Despite Solana’s descent to $80, some traders find security as smart money enters the fray, suggesting…

XRP Price Prediction: Major Ledger Upgrade Quietly Activated – Why This Could Be the Most Bullish Signal Yet

Key Takeaways: The activation of the Permissioned Domains amendment on XRPL represents a significant development in XRP’s potential…

Dogecoin Price Prediction: Death Cross Confirmed as DOGE Falls Below $0.10 – Is DOGE Reaching Zero?

Key Takeaways The death cross event signals potential bearish trends for Dogecoin as its price dips under $0.10,…

Stablecoin Inflows Have Doubled to $98B Amid Selling Pressure

Key Takeaways Stablecoin inflows to crypto exchanges have surged to $98 billion, doubling previous levels amidst heightened market…

February 9th Market Key Intelligence, How Much Did You Miss?

After being questioned by Vitalik, L2s are collectively saying goodbye to the "cheap" era

WEEX AI Trading Hackathon Paris Workshop Reveals: How Retail Crypto Traders Can Outperform Hedge Funds

Witness how WEEX's Paris AI Trading Hackathon revealed AI's edge over human traders. Explore key strategies, live competition results & how to build your own AI trading bot.

U.S. Oil (USOR) Price Prediction 2026–2030

Key Takeaways U.S. Oil (USOR) is a speculative Solana-based crypto project that aims to index the United States…

USOR Surges on Meme Narrative Despite No Real-World Asset Backing

Key Takeaways: USOR, a Solana-based token, has seen a notable surge driven by speculative narratives rather than verifiable…

How to Buy U.S. Oil Reserve (USOR) Cryptocurrency

Key Takeaways U.S. Oil Reserve (USOR) is a Solana-based token primarily traded on decentralized exchanges (DEXs). Claims have…

Earn

Earn